Education Tax Rates and Taxes: Updates and Information

(Updated September 2024)

As the new school year begins, the Lincoln School District (LSD) and Board would like to share some updates about education tax rates since Town Meeting, and about increases in homestead taxes in the Lincoln community.

In Brief:

The tax rates we presented at the 3/4/24 Town Meeting have all been revised downward, using final values for the Property Yield and Lincoln’s Common Level Appraisal (CLA).

FY25 budgeted education spending increased very modestly over FY24, below average for Addison County and well below the statewide spending increase.

By far, the largest driver behind the increase in Lincoln’s homestead education taxes this year is the spike in Lincoln property values, not the relatively small increase in district spending.

The increase in homestead taxes this year is not a result of being an independent school district. In fact, since LSD was established (FY24):

pre-CLA tax rates have decreased compared to prior years as part of MAUSD, and have been comparable to MAUSD rates without Lincoln over the same period; and

Lincoln’s 2-year total tax is comparable or considerably lower than the total in each MAUSD town.

FY25 Homestead education tax rates revised downward from initial estimates

At Town Meeting in March, 2024, the LSD Board presented calculations to estimate Lincoln’s FY25 Homestead tax rate, which is ultimately set by the state.

Using the final values for the Property Yield (set by the Legislature) and the CLA (set by the state), the final tax rates are lower than what we originally presented. Updated calculations are in the table provided below.

For convenience, here are the changes from the presentation at Town Meeting:

Property Yield $9,775 >> Final value $9,893

CLA 100% >> Final value 115%.74

Est. equalized (pre-CLA) Homestead Tax Rate: $1.4818

(vs. 1.4639 actual)

Est. final Homestead Tax Rate: $1.4818 (vs. $1.2648 actual)

The FY25 spending increase was moderate, in absolute terms and relative to local and statewide increases

The table below displays education spending and tax rates for FY24 and FY25.

Lincoln’s 5.9% education spending increase from FY24 to FY25 is the second-lowest in Addison County, and below the County’s 6.6% average increase. Arranged in order from smallest to largest, these increases are MAUSD: 4.5%; LSD: 5.9%; ANWSD: 7.7%; ACSD: 8.2%.

Further, this increase is well below the 10.7% statewide increase in education spending.

*Education spending is Vermont’s term for voter-approved budget expenditures minus local revenue. As a rule, school districts do not raise all education spending from local taxes: the percentage raised locally varies by district, and the state uses the Education Fund for the remainder. In recent years, both LSD and MAUSD have been supported by the Education Fund for around 40% of district spending.

FY25 Homestead property taxes

1. The sharp increase in homestead taxes this year is not driven by increases in district spending.

As noted above, FY25 education spending did not sharply increase over FY24, and spending per pupil is a significant part of Lincoln’s state-determined homestead tax rate. However, the value of Lincoln’s grand list spiked compared to last year, and individual homestead property taxes are calculated using the homestead tax rate and the grand list value of property,

This means that, in general terms, the change in property values is the primary driver of the increase in Lincoln’s homestead education taxes.

Understanding why this is so in more precise, quantitative terms requires a deeper dive into Vermont’s overall education funding system– as well as specific elements within it– information we hope to provide soon. For now, however, looking at an example provides some insight.

2. How increased education tax is primarily attributable to increases in property value

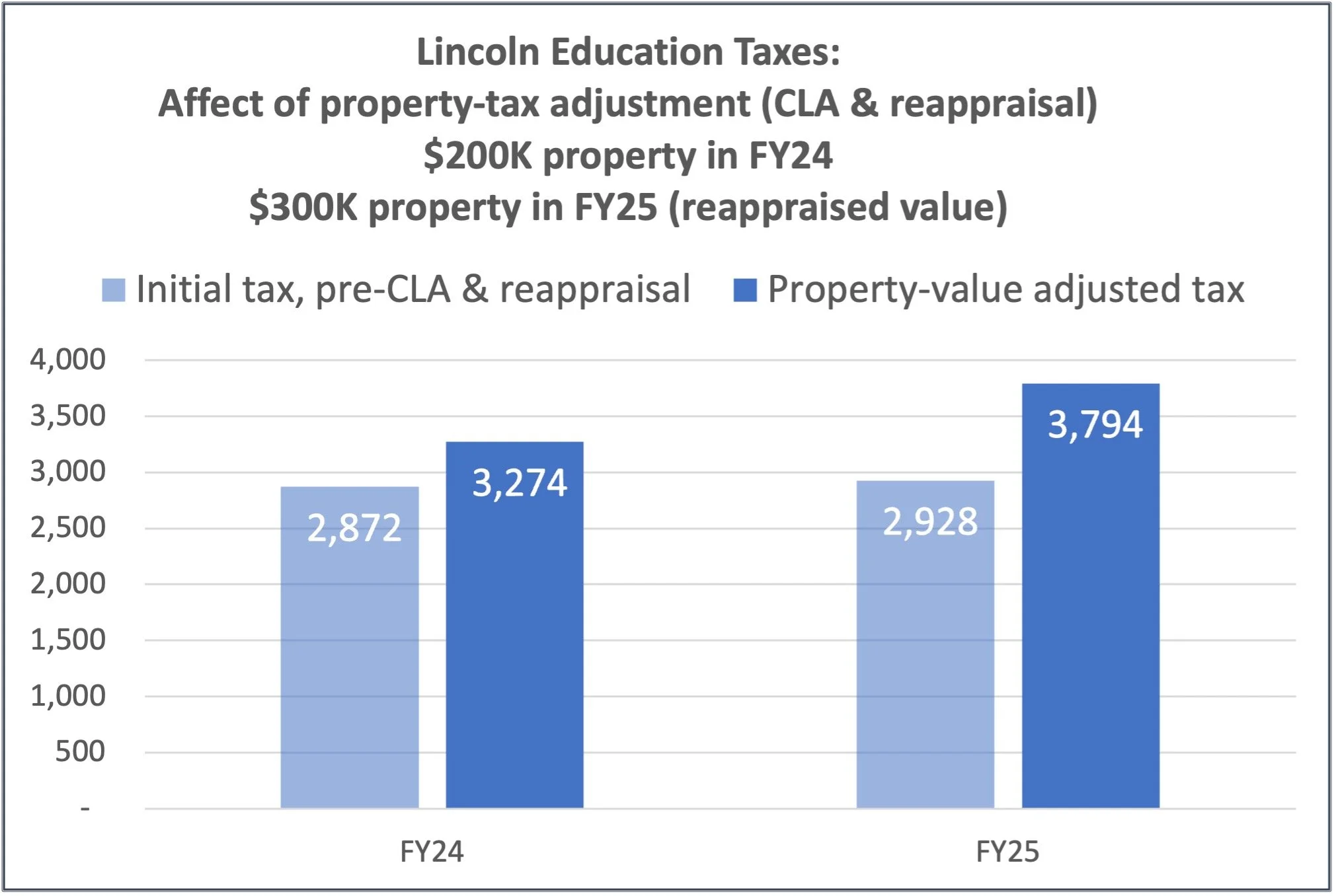

For this example, suppose that the listed value of a property in Lincoln was $200,000 before the town-wide reappraisal and $300,000 after. The chart below displays the difference in homestead education taxes two ways:

the tax on $200K in each year, using each year’s pre-CLA tax rate (light-blue bars)

the final education tax, after applying corresponding property adjustments from the CLA and town-wide reappraisal (dark blue bars).

As the lighter bars in the chart indicate, the increase in pre-CLA tax is very small: just $56, or around 2%. This corresponds to the 2% increase in pre-CLA tax rates, and reflects a small increase in per-pupil district spending.

The darker bars tell a different story: after adjusting for property value, the actual tax in each year is considerably higher than the pre-CLA tax. For FY25, in particular, the change is dramatic. Moreover, the 16% increase in taxes is almost entirely from the change in property value.

1-year increase in property value from $200K to $300K has a significant impact on total taxes paid, independent of actual spending changes in the district.

3. The sharp increase in homestead taxes this year is not a result of being an independent school district.

As indicated in the prior section, the change in homestead taxes this year is driven primarily by a spike in property values. Further, education tax rates cannot be locally adjusted downward to compensate– as can be done for the municipal tax rate– since the state, not towns or school districts, sets education tax rates.

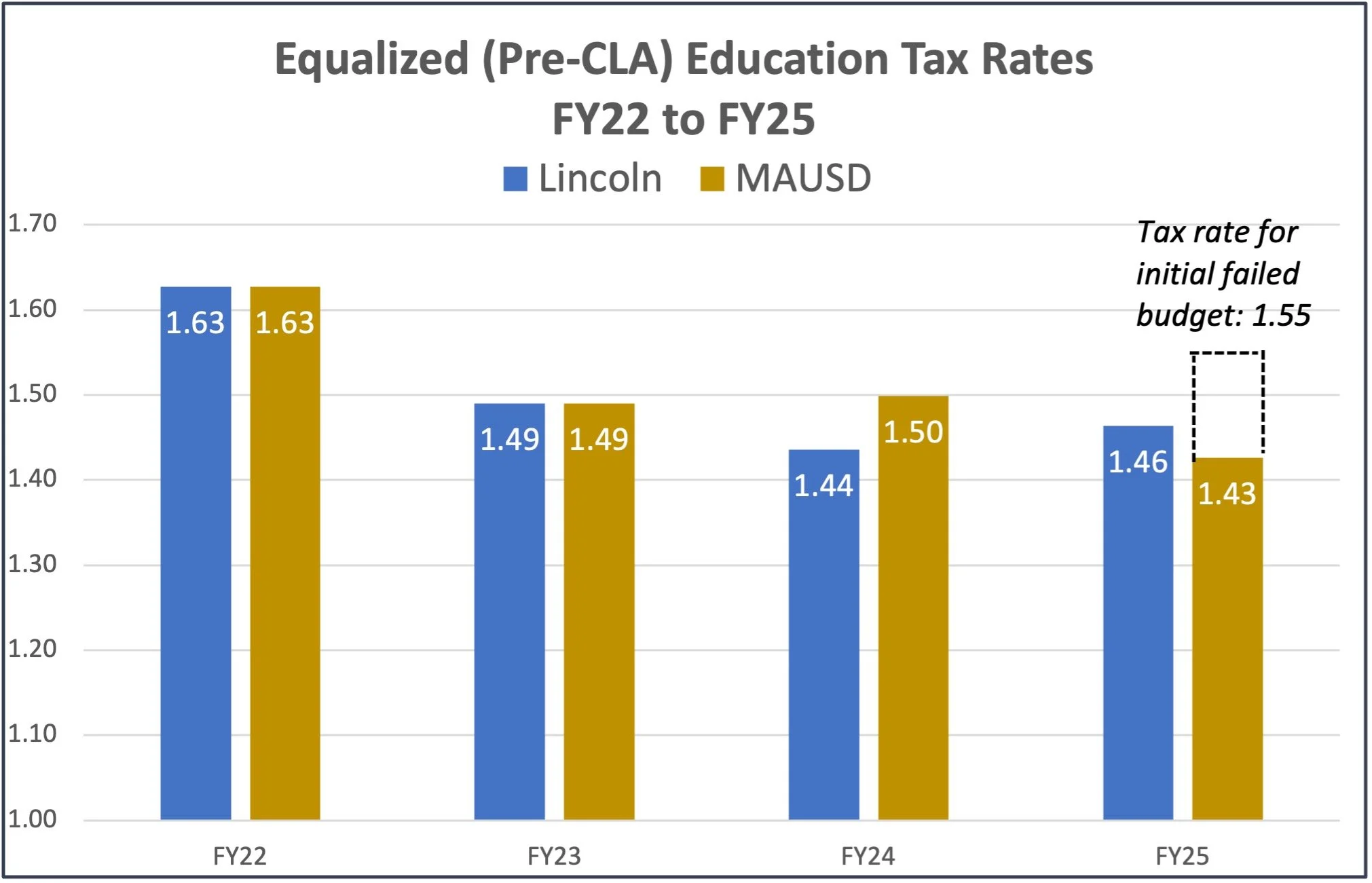

Actual spending increased modestly since Lincoln became a stand-alone district, and pre-CLA tax rates in fact have decreased and been comparable to MAUSD’s rates (see figure, below). As a result, Lincoln would have experienced sharp increases in education taxes this year, regardless of our status as an independent district.

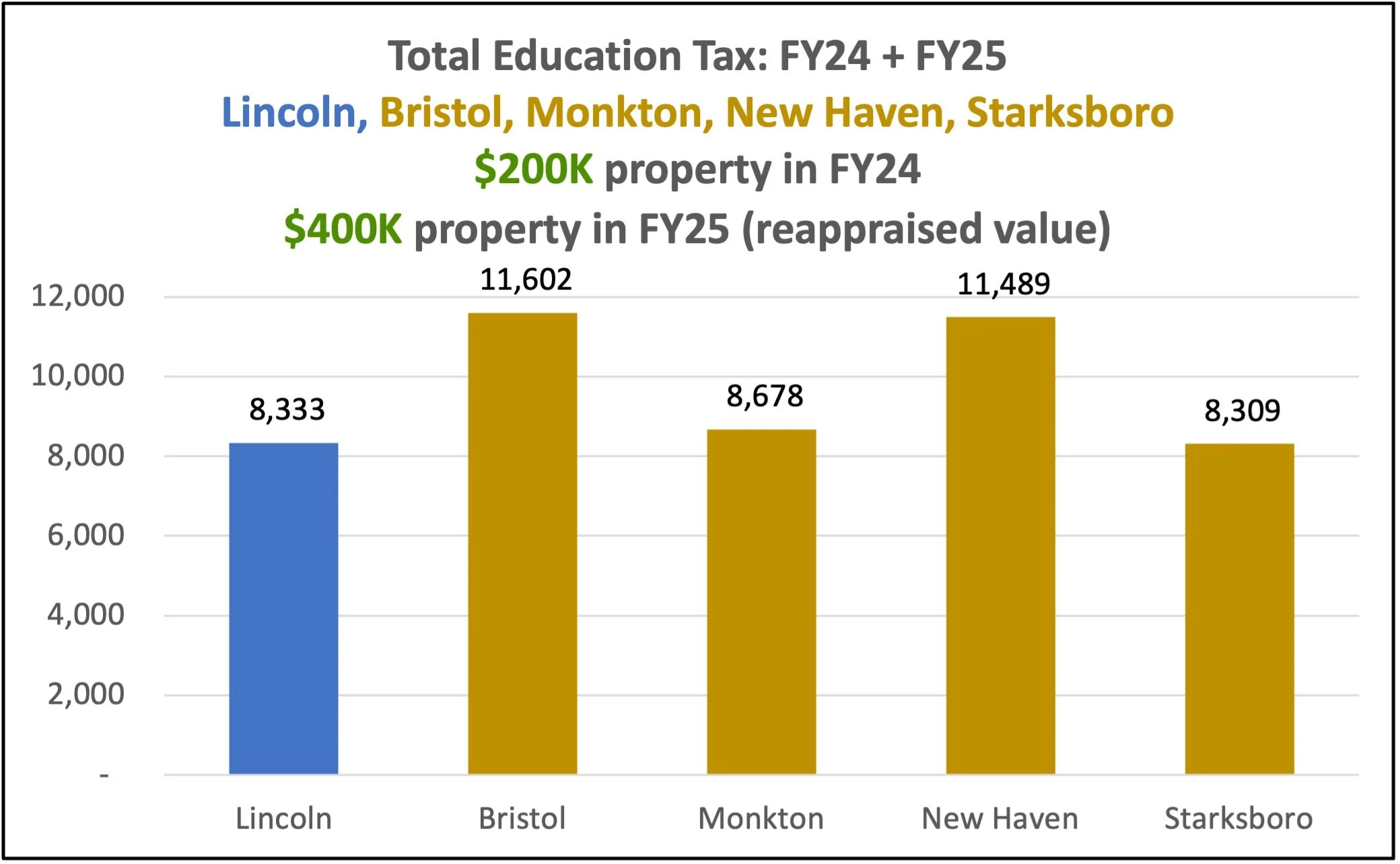

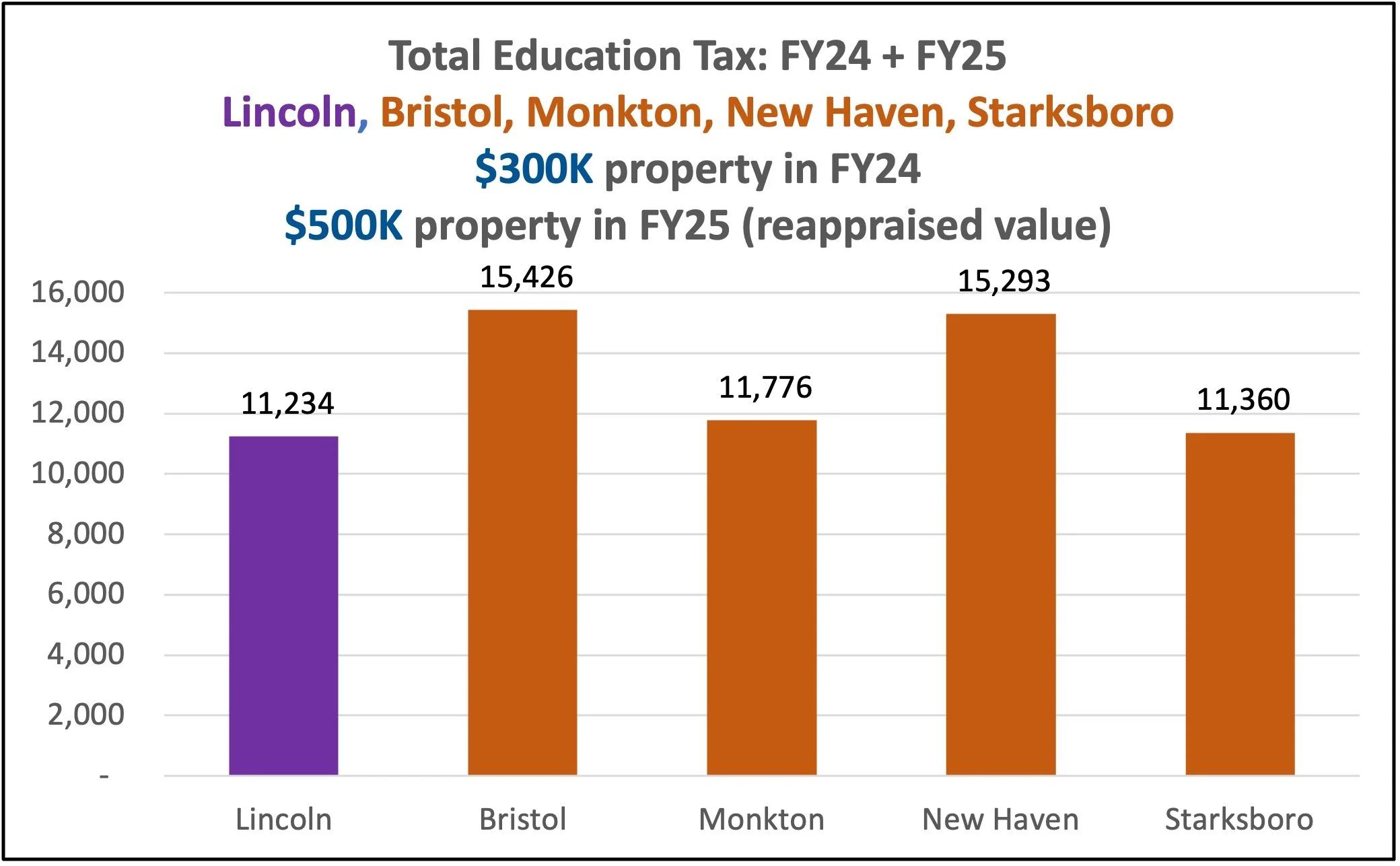

Moreover, since becoming an independent district, Lincoln’s 2-year total tax is comparable or considerably lower than the total in each MAUSD town, as shown under several scenarios in the following charts.

Since LSD was established, pre-CLA tax rates have decreased and have been comparable to MAUSD rates without Lincoln.